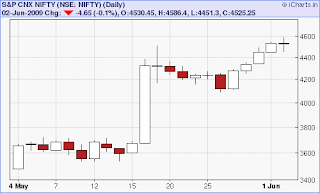

Ok, to begin with since I was traveling, the first time today I looked at the market was around 1 pm. By that time the market was in clear down trend for the day with spot Nifty around 4330. My first trade was a short sell which unfortunately was stopped out because too tight a stop loss.

Ok, to begin with since I was traveling, the first time today I looked at the market was around 1 pm. By that time the market was in clear down trend for the day with spot Nifty around 4330. My first trade was a short sell which unfortunately was stopped out because too tight a stop loss.And then I misread the market movements because of a preconceived notion and the temptation alluded to above.

Between 1 pm and 2.15 pm, Nifty moved between 4330 and 4310 twice finding support at 4307/4305. Based on Nifty weekly pivot of 4302, I had this preconceived notion that this will be a very strong support. Also at the back of my mind I have been playing the tune that the market has fallen so much, it must find support .

Stupid me.

So despite clear STRONG down trend, I bet on a reversal with Nifty Future rebounding from 4297, I went long at 4323 Nifty Future with stop loss below 4297. And promptly lost 33 Nifty points. Subsequently, I did short and recovered a part of the loss. BUT the psychological damage was more difficult to handle.

I learned two lessons today.

1. When there is a tussle between price action and predetermined levels - follow the price trend.

2. If you follow the path of temptation and predict turnaround, you will be discarded by the market 1 out of 20 times.

In case you want to read about my previous post on dangerous temptation, it can be found here.

If you have any comments please write to me at stockmarket.methods.in.madness@gmail.com

![]() Like this post? You can receive it free by subscribing. Just click on this link

Like this post? You can receive it free by subscribing. Just click on this link

Disclaimer: The above analysis is just that - my analysis. If you choose to trade on the basis of this analysis, you will be solely responsible for the outcome of the trade - profit or loss. Please keep in mind that trading and in particular day trading is not for the novice and there is significant risk of loss of capital in trading.