"

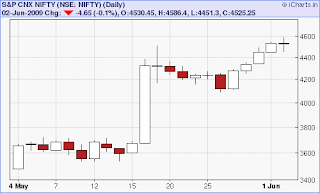

Whichever way you look at it, whether it is the daily chart or the weekly chart, Nifty has been trading in a 15% range (4000-4600) since the big gap up post election.

Thrice it has tried to breakdown below 4200/4100/4000 and thrice it bounced back - the last time it bounced back it made a fool of people - including me - who had discovered the head and shoulder and thought that the market was about to go down and close the gap.

On the upside it tried to take out 4700 and failed; again in the last week and this week it is trying to breakthrough 4600, and right now it is faltering a bit ( who knows what will happens today and tomorrow and next week ..... ).

Clearly, one possibility is that it will breakout above 4700.

The other possibility is that it will be range bound between 4000-4600 for another 10 weeks!!!

"

However I do not understand what the big fuss is about. In the last two weeks, there has been plenty of good intra-day set ups. So day trading is un affected by this. The interesting fact is that day trading ( or any trading ) requires just the right amount of volatility appropriate for that time scale.

The real difficulty caused by the rangebound Nifty is being faced by positional trader and swing trader. Because every time they think that Nifty is breaking down or breaking out, it reenters the range.

But such is life, the market is not going to oblige your style all the time. However, I strongly beleive that trading opportunities are still there IF YOU LISTEN TO THE RANGEBOUND MARKET.

If you have any comments please write to me at stockmarket.methods.in.madness@gmail.com

![]() Like this post? You can receive it free by subscribing. Just click on this link

Like this post? You can receive it free by subscribing. Just click on this link

Disclaimer: The above analysis is just that - my analysis. If you choose to trade on the basis of this analysis, you will be solely responsible for the outcome of the trade - profit or loss. Please keep in mind that trading and in particular day trading is not for the novice and there is significant risk of loss of capital in trading