There were four speakers.

Here are my personal take aways.

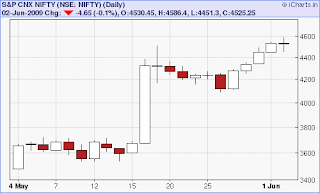

The first speaker was Sudarshan Sukhani. He was at his usual best. His statement about the market movement in the immediate future is that since the trend has been up, we must trade in that direction and there is not much use speculating where the top would be. When the trend reverses as it surely will, we should be prepared to trade in the other direction.

He presented several techniques on "Buying on Dips". He distinguished between two situations,

1. The first one was when the market in a sideways rangebound movement in an overall uptrend. The appropriate indicators are Bollinger Bands, Kelter Channels, CCI-100, EMA-50 and idea is to wait for the price to touch the lower ( or middle as appropriate) bands.

2. The other situation is when a strong uptrend has resumed, In such cases, the price may not dip to the lower bands mentioned above and the appropriat3e indicators would be Triangle formation, NR7, or Wedge patterns. The idea is to wait for such patterns to happend after resumptions of a trend and then trade in the direction of the trend.

For me, the presentation answered a long standing question as to which dip indicator is suitable for which occassion. The clarity of this presentation was just amazing.

I would summarize the other speakers in future posts.

If you have any comments please write to me at stockmarket.methods.in.madness@gmail.com

![]() Like this post? You can receive it free by subscribing. Just click on this link

Like this post? You can receive it free by subscribing. Just click on this link

Disclaimer: The above analysis is just that - my analysis. If you choose to trade on the basis of this analysis, you will be solely responsible for the outcome of the trade - profit or loss. Please keep in mind that trading and in particular day trading is not for the novice and there is significant risk of loss of capital in trading