Before we discuss today's nifty price movements, let us start with a very important topic, namely, relevance of the opening price in day's trading.

Here I can do no better than quoting from

Brett Steenbarger's recent blog post on 21 May 2009. Here is the opening paragraph:

"

The opening price .... represents the market's first attempt at locating value on the day. A trending market will stay above or below the opening price for the majority of the session, as we reject that early estimate and probe value higher or lower. A bracketing or range market will tend to accept the early estimate of value, and we will oscillate around the open and/or the day's volume-weighted average price for much of the session.

"

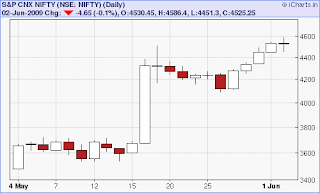

Coming back to today's trade, it opened higher and within half an hour raced towards 4545 which it reached at 10.22 am. Now the index had gone up so much in the last two days, so the question was, is it going to be another tear away day, or will it be range bound and will the market accept the market opening as a fair value?

Such questions can only be resolved by waiting for the day to unfold. As it happened, by 11 am it was obvious that 4545 was the day's tentative high and the market was falling from there. The prudent thing to do was to wait again and see if yesterday's closing held. It did. It reached 4476 at 11.22 and began to turn up.

Thus by 11.30 am, the market had established the day's high at 4545 and day's low at 4476. And the chance increased that it was going to be a range bound day.

Notice also that the market established another support level around 4495 which it visited thrice during the course of the day. By this time, it was a relatively safer bet to put in a long trade around Nifty 4500 with SL at 4476. In other words, we could treat 4500 as a support level with 4476 as the "get me out of here" kind of SL level got long trades.

One can argue that hindsight is 50-50 and it is easy to analyse these at the end of the day rather than during the day. That is true. However, it is only by analysing such price actions can we develop our own approaches to identifying support resistance levels in future trading days.

The other interesting point is that this whole analysis is solely dependent on the day's price action, no fancy indicators needed, only requirements are patience and interest in listening to the message of the market for that day.

What about tomorrow?

Well, again watch out for the opening price and look at the price action to gauge whether the market is accepting the opening price as the fair value or not.

Wherever it opens, if it moves above 4555 and continues to stay above 4555, we can go long with initial SL at 4500. Use trailing SL to protect gains.

Wherever it opens, if it trades below 4490, we can short there with SL at 4535, and target 4450.

The price in the range of 4550 and 4490 is a kind of oscillating zone. I shall try to resist temptation to trade while the price is in this range.

We will know by the end of tomorrow how things pan out, won't we?

Disclaimer: The above analysis is just that - my analysis. If you choose to trade on the basis of this analysis, you will be solely responsible for the outcome of the trade - profit or loss. Please keep in mind that day trading is not for the novice and there is significant risk of loss of capital in trading.

![]() Like this post? You can receive it free by subscribing. Just click on this link

Like this post? You can receive it free by subscribing. Just click on this link